Pure Nickel becomes Eric Sprott's 51% partner on the Neal Project

TORONTO: April 30, 2019. Pure Nickel Inc. (TSXV: NIC) (the “Company” or “Pure Nickel”) announces that it has signed an Agreement (the “Agreement”) with 2176423 Ontario Ltd., a company controlled by Eric Sprott (“Sprott Mining”) outlining the arm’s length terms for the acquisition by the Company of an initial 51% of the Neal Development Limited Partnership (“Neal LP”) from Sprott Mining together with an option to acquire an additional 27% of the Neal LP and 7 unpatented mining claims. The Neal LP holds a lease to operate the Neal Project, which is a gold project comprised of 5 patented and 7 unpatented lode mining claims located 27 kilometers southeast of Boise, Idaho.

There are currently 200 outstanding limited partnership units in Neal LP of which Sprott Mining owns 142 units and has the option to acquire another 54 units (total of 196 units or 98% of the units). Four units are held by a separate party. All dollar figures in the release are US$.

Under terms of the Agreement Pure Nickel would:

- Acquire 102 units of Neal LP (51%) in consideration of the issuance to Sprott Mining of 10,221,731 shares of the Company or approximately 15% of the currently issued and outstanding shares of the Company. Upon completion of the share issuance, Pure Nickel will become the operator of the Neal Project.

- Have an earn-in option to acquire an additional 54 units (27%) of Neal LP and 7 unpatented mining claims by raising between $1–$1.5 million for an exploration drill program. Upon completion of this future financing, Pure Nickel has the option to pay Sprott Mining $84,706 ($1,568.63 per unit) causing Sprott Mining to exercise its option to acquire the remaining 54 units and assign them to the Company, it will also transfer its interest in the 7 unpatented mining claims to the Company. Upon completion of this earn-in option, Pure Nickel will own 156 units or 78% of Neal LP, while Sprott Mining will retain 40 units or 20%. A separate party will continue to hold the remaining 4 units or 2%.

The Neal LP currently leases the core patented private property at the Neal Project from Daisy Mining & Land, LLP, and the underlying claim holders. Under the lease agreement, Neal LP may remove, extract, ship and sell all ores, minerals and material from the property. In exchange, Daisy Mining will be paid lease payments equal to $3.00 per ton for all material removed from the property. If the annual lease payment is less than $10,000, Neal LP will pay Daisy Mining a cash top-up to meet the $10,000 annual payment minimum. Daisy Mining will also receive production payments on any future production in the form of a 3% NSR.

The completion of the transaction is subject to TSX Venture Exchange approval.

Pure Nickel’s President and CEO, R. David Russell, commented, “We are very pleased that Eric Sprott has agreed to allow Pure Nickel to become the operating partner in the Neal Project, while at the same time becoming a significant shareholder of the Company. With the acquisition of a controlling and operating interest in the Neal Gold Project in Idaho, we believe we have made the first key strategic step for Pure Nickel to expand the Company’s focus to include gold and silver exploration and development.”

ABOUT THE NEAL PROJECT

Geology-

Neal is a high grade gold-dominant discrete vein system with at least 5 veins known to date. Test mining in recent years from the top of the historic vein zones exploited near surface stockwork veining left behind by previous operators. Most of the veins are parallel and strike north-easterly with moderate southerly dips within a regionally extensive fault system, probably related to the nearby Trans-Challis fault zone. Veining consists of quartz- white mica- clay, with the better gold grades directly related to iron oxides after pyrite near surface and pyrite at depth. The primary host rock is a fairly uniform Cretaceous-age biotite granodiorite that is part of the southern margin of the extensive Atlanta Lobe of the Idaho Batholith. Tertiary-age bi-modal lamprophyre and rhyolite dikes intrude the same faults that host the vein zones at Neal; a common theme in many other gold mines in the region.

Property Description-

The Neal Project is located near Boise, Idaho and has excellent access via 20 kilometers of improved gravel and dirt roads from Interstate-84. A 25-minute commute from Boise provides easy access to the many private and government services available in Idaho’s largest city. The rolling hills in the area are part of the Danskin Mountain Range, but are arid and mostly covered by sage and scrub-brush. Although one small underground gold mining operation is located approximately 4 miles on strike to the southwest from Neal, most of the industry in the immediate area is ranching related. Neal private property consists of 5 patented mining claims covering approximately 22.4 hectares (55.38 acres) and another 7 unpatented lode claims covering about 52.6 hectares (130 acres) located on Forest Service administered public lands.

Historic Underground Gold Mining-

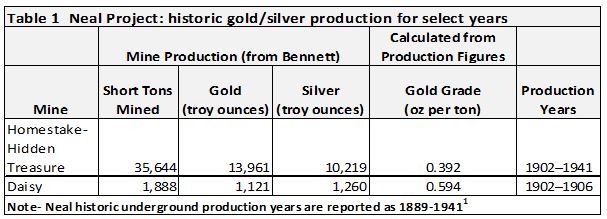

The project site was the most productive gold producer in the Neal Mining District, with underground production from 1889 through 1941 sourced mainly from the Hidden Treasure, Homestake and Daisy Mines. According to US Bureau of Mines records, the Neal Mining District is estimated to have reported production of at least 30,000 ounces of gold, with most of this coming from the Neal property1 . Table 1 provides a summary for a select range of historic underground production years for which data is available.

Historic Exploration Drilling and Trenching-

In the 1989-1990 time period, Centennial Mining completed a reverse circulation drill program targeting near surface oxide gold mineralization that consisted of 190 vertical and 18 angle holes totaling 47,655 ft (14,525 m). Although this drilling was not the first at Neal, it was the first extensive program intended to define a resource for a contemplated open pit heap leach gold operation. The program was generally successful in identifying five vein zones and accessing near surface oxide potential.

Later work in the 2007-2013 timeframe by Aquasolum Consultants followed up key intercepts (Table-2) from the earlier Centennial program with additional trenching. This detailed surface trench work better defined vein and stockwork gold mineralization found in the earlier drilling and produced samples for metallurgical and mine development studies.

Recent Bulk Sampling-

In 2015, Neal Development LP started development work on an open cut exploration program at the Neal mine. This program was designed to provide adequate sample volume for further metallurgical and mill recovery work. The open cut produced a 12,900 ton sample of gold mineralized material that averaged 0.140 troy ounces per short ton (opt)2 . The qualified person has not done sufficient work to classify this historical estimate as current mineral resources or reserves and the Company is not treating the historical estimate as current mineral resources or mineral reserves. This stockpile remains onsite and under terms of the Agreement, Sprott Mining retains the rights to the stockpiled material.

The Neal Mine Project is a fully permitted Mine Operation. An environmental reclamation plan approval, which becomes the operating permit, was issued for the Neal Project on April 20, 2017 and a surety bond of $175,000 must be posted under the current permit for the full mine project which allows for drilling, exploration and mining (Atlanta Gold Inc. press release2). Of this $175,000 total bond, an initial $87,500 is in the process of being posted by the Neal Development LP. Any additional mining of the open pit will require an additional $87,500 be added by the operator to complete the full bonding at $175,000.

Plans for 2019-2020-

In the near term, Pure Nickel technical personnel will organize and assess existing exploration data from past operators and complete an updated geologic map and surface sampling program. Historic data will be combined with surface geology/geochemistry and any new drill data to better define underground vein targets. This is expected to allow for selective targeting during a follow-up drilling program later in the year.

Comments on Historic Drilling and Sampling-

The Company has not done sufficient work to verify historic drilling or sampling results. However, the Company considers that the historic information is relevant for early-stage project assessment based upon Pure Nickel’s due diligence work, which includes property visits and the review of historic reports, maps, and technical data.

Sources Cited-

1 Bennett, Earl H., 2001. The Geology and Mineral Deposits of Part of the Western Half of the Hailey 1o x 2 o Quadrangle, Idaho, USGS Bulletin 2064-W, prepared with Idaho Geological Survey, Idaho State University and the University of Idaho: with a section on the Neal Mining District by Thor H. Kiilsgaard and Earl H. Bennet (pp 24-29).

2 Atlanta Gold Inc. news releases dated Dec 9, 2015 and April 26, 2017.

ABOUT PURE NICKEL INC.

Pure Nickel is a mineral exploration company with a focus on exploration and development projects in North America. Pure Nickel owns William Lake, a nickel exploration project in northern Manitoba. The Company recently sold two of its nickel assets and is now gearing the exploration portfolio to also include gold and silver exploration and development.

The technical information contained in this news release has been reviewed and approved by Thomas H. Chadwick, BSc., CPG, a Qualified Person under National Instrument 43-101 Disclosure Standards for Mineral Projects.

For further information:

Pure Nickel Inc.

R. David Russell

Chairman and CEO

T. (416) 644-0066

info@purenickel.com

www.purenickel.com

Forward Looking Statements

Some of the statements contained herein may be forward-looking statements which involve known and unknown risks and uncertainties. Without limitation, statements regarding potential mineralization and resources, exploration results, expectations, plans, and objectives of Pure Nickel are forward-looking statements that involve various risks. The following are important factors that could cause Pure Nickel’s actual results to differ materially from those expressed or implied by such forward-looking statements: changes in the world-wide price of mineral commodities, general market conditions, risks inherent in mineral exploration, risks associated with development, construction and mining operations, the uncertainty of future exploration activities and cash flows, and the uncertainty of access to additional capital. There can be no assurance that forward-looking statements will prove to be accurate as actual results and future events may differ materially from those anticipated in such statements. Pure Nickel undertakes no obligation to update such forward-looking statements if circumstances or management’s estimates or opinions should change. The reader is cautioned not to place undue reliance on such forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.